Research bits #1: The Most Underrated Metric in (Factor) Research

We’re switching over to small, more frequent posts that are easier to write & read - hope you like it!

One of our biggest factor research breakthrough came when we made turnover a first class citizen. The lesson was: high IC is essential, but not sufficient by itself.

It’s easy to skim over the fact that a high turnover factor is not directly comparable to a low turnover one - they’re qualitatively different, and will exhibit fundamentally more or less (statistical) significance.

We also started to systematically turn unprofitable, too-high turnover factors into profitable ones by applying simple smoothing / moving averages.

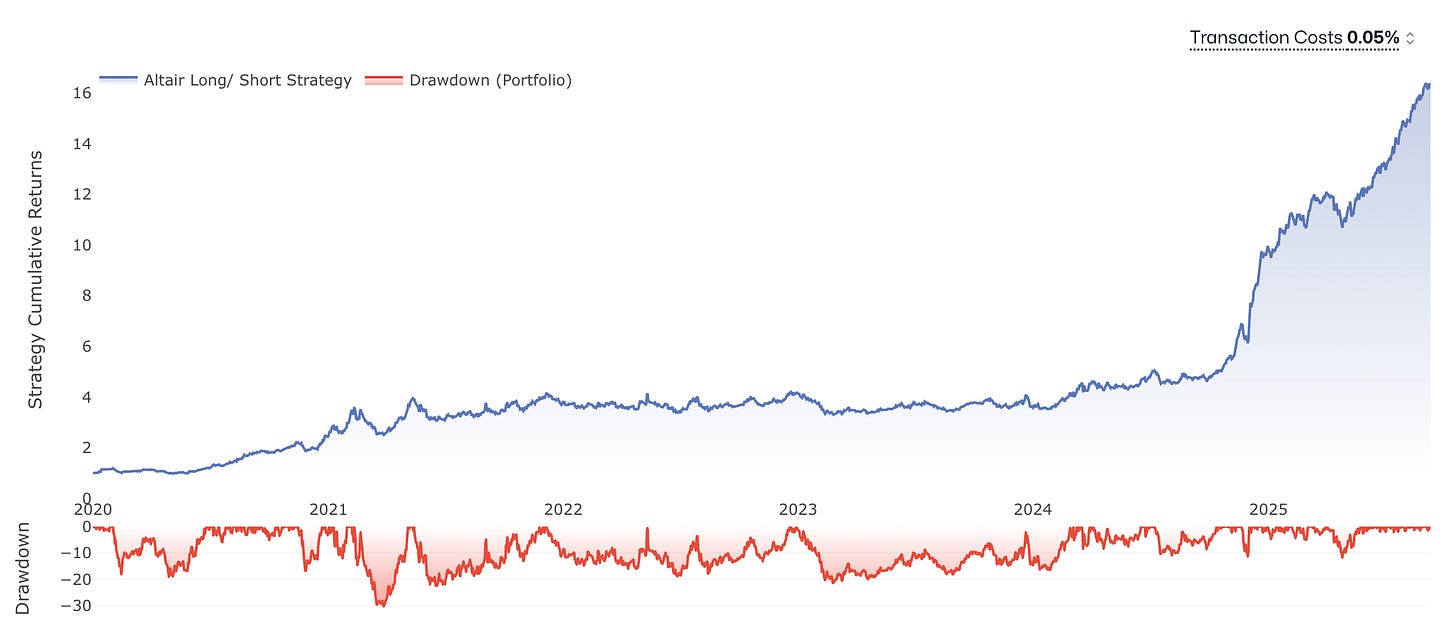

Example: Altair, our highest variance factor, flips the portfolio almost daily—completely unrealistic once costs are included. To keep ourselves honest and avoid overfitting, we target a daily turnover of 30-40% for any factor (that has a higher turnover by default) — before we even look at performance.

This avoids the usual bias towards performance, as well as it makes the factors comparable.

See the difference yourself: “Altair” raw (with 100% daily turnover)

When we apply a 20-day moving average:

As always, happy to connect on LinkedIn and talk shop!

Catch you in a couple of days with another short post!